This tried and true saying applies not only to a trade-in, but to your hiring practices. Business owners are realizing that hiring the right people in the first place helps avoid many situations that could lead to theft, losses, employment-related lawsuits, and customer relations nightmares. For example, some sources estimate that 30 to 40 percent of all information given on resumes and job applications is false or misleading. Courts often hold employers liable for the actions of their employees, and one oversight or shortcut in the hiring process can have devastating consequences for your business, your family, and your reputation in the community.

With access to valuable inventory and personal information, dealership employees represent a significant risk to the business that needs to be recognized and addressed with proper risk management procedures. As you're considering the impacts of HIPAA, FACTA, Red Flag, and other regulations on your business processes, consider an additional process that can mitigate the risks of hiring.

Consider the reality

A dealership hired a male employee as a clerk. Later, that employee lured a female employee out of the building by asking for help at another location. Then he forced her into his car, and assaulted her. She later escaped and the man was arrested. The employer learned too late that the person had a prior criminal record, including violent crimes.

In this case, the female employee suffered severe emotional trauma and was placed on disability, which could affect the business' workers compensation costs for several years. The crime also damaged employee morale and the negative publicity hurt the business.

So-called ‘minor' oversights have also resulted in a world of trouble for some businesses and affected their communities. Fortunately, not all mistakes result in catastrophes, but no matter what types of loss a business experiences, the root problems nearly always come down to people.

Think about the people you've hired in the past. Was there anything you learned later about the person that you wish you had known before offering the job? Did you follow strict hiring procedures that would have brought top people to your company? Although there may not be a ‘silver bullet' to ensure you hire only the top performers, you can improve the chances of finding quality people who will contribute to your organization.

The key is consistent hiring practices

Don't skip steps. Most owners or managers that have made a hiring mistake will admit they skipped one or more steps in the hiring process that came back to haunt them.

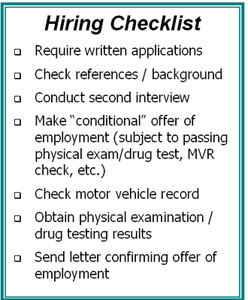

The hiring checklist provided should help you review your company's hiring procedures. Determine if you're thoroughly checking the employment history and background of people you're putting on the payroll. Be certain that all managers with hiring responsibilities know your expectations and follow procedures consistently.

Many human resources professionals believe that the most important, yet often overlooked, step is to always do reference and background checks. Never omit these checks. Explore any employment history gaps during the interview process until you're satisfied with your candidate's history. And, if the prospective employee will ever be behind the wheel of a company or customer's car, a driving record check is always a must.

AIADA's Affinity Partner, Federated Insurance, continually emphasizes the risk management aspects of dealership hiring practices, with over 11 years of serving AIADA members. Federated's property and casualty insurance program for auto dealers provides quality coverage and risk management assistance to help dealers prevent losses and reduce claims costs. With over 100 years of experience and hundreds of dealership clients, Federated understands the risk inherent with automobile dealers and has highly qualified field representatives to help you get the most value for your insurance dollars.

Federated Insurance's field representatives are committed to helping their clients design and implement a comprehensive hiring procedures program to help policyholders reduce the risks and losses associated with employment related issues. The program includes a video called "The Faces of Your Business" and an information packet filled with sample procedures, forms and other valuable resources for setting up procedures that may help you find the best faces for your business. To learn more about this program, contact Nate Oland, National Account Executive, at 800-533-0472 or NSOland@fedins.com.

This article is intended to provide general recommendations regarding risk prevention. It is not intended to include all steps or processes necessary to adequately protect you, your business or your customers. You should always consult your personal attorney and insurance professional for advice unique to you and your business.