In these competitive times, successful entrepreneurs look for every legitimate edge as they operate their businesses. Many entrepreneurs like to be rewarded for the positive results of their business practices and controls, and prefer to receive up-front premium savings in exchange for some increased risk.

Auto dealers insured with Federated Insurance may be eligible to achieve this through Federated's Self-Insured Retention (SIR)* program. The SIR plan is an innovative strategy that more directly ties insurance costs to risk management activity. By self-insuring some part of your risk, you can gain more control over your cost of risk, while gaining potential cash flow advantages.

How does the Self-Insured Retention plan works?

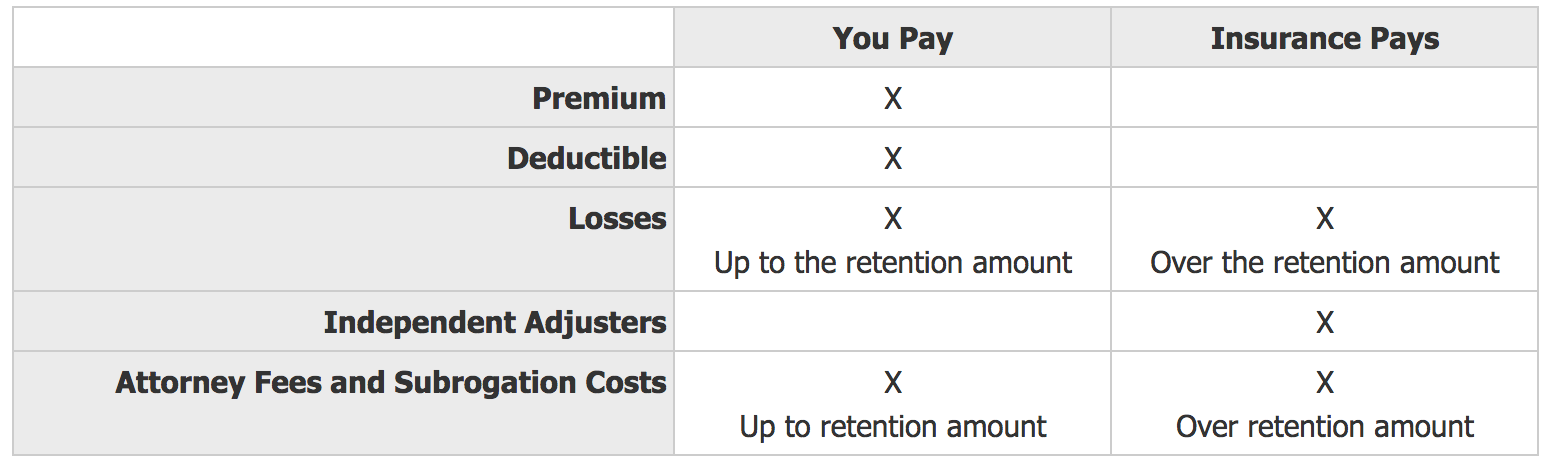

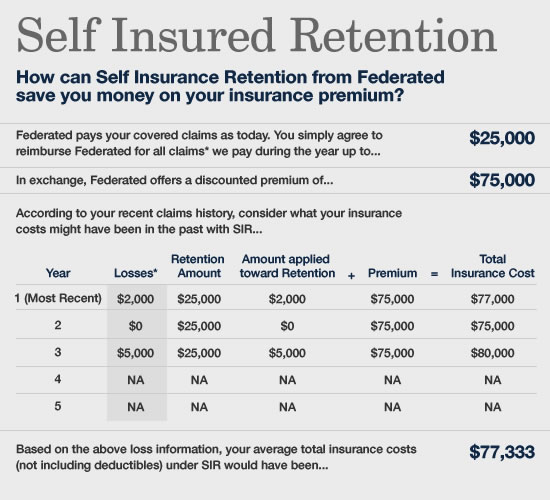

This plan, simply put, allows the insured business to "retain" a portion of risk in exchange for up-front premium savings. A retention amount is determined, then the business pays for any claims and legal costs up to that dollar amount. Anything above the retention limit and deductible amounts are insured by Federated (up to the limits of the policies included in the plan). Your business is still protected for catastrophic losses, and if actual claims are less than the retention amount, the business also benefits from the lower out-of-pocket costs. The savings may help you purchase other needed coverage or invest in risk management improvements, which helps control claims.

The SIR program has already benefited many large and medium-sized dealers. This simple plan allows a business to retain more of the insurance risks, while offering an opportunity for significant up-front premium savings. Federated can work with you to set a retention amount you will be comfortable with, typically ranging from $15,000 to $200,000.

How does an auto dealer decide which risks to self-insure?

Self-insurance includes a variety of strategies - everything from assuming larger deductibles to choosing not to insure a particular risk or peril at all. In order to recognize the benefits of self-insurance, you must first identify and then classify the types of risks faced in your operation. Typically, risks can be grouped into three distinct categories:

-

Catastrophic loss is the type that could potentially close the doors of the business.

-

Setback loss is the type that may create serious financial hardships but will not force the closure of the business.

-

Nuisance loss may create small financial hardship but is more of an inconvenience than a financial threat.

The cash flow and financial circumstances of each dealership will dictate whether a $20,000 loss, for example, will be classified catastrophic, a setback, or merely a nuisance.

You should not accept more risk than you feel comfortable assuming. However, self-insuring certain types of risks may make sense based on the effort and attention given to various risk prevention strategies. In addition to up-front premium savings, additional savings could result from the positive impact of improved claims experience on your company's overall insurance premiums.

You'll get personal assistance

You are not on your own managing the risks included under the SIR Plan. Federated will put our resources to work for you. Together, we can meet your safety goals by:

-

Identifying loss prevention needs and safety assistance opportunities

-

Analyzing claims trends on a regular basis

-

Helping determine specific strategies for addressing loss issues

-

Developing and implementing a 3-year Loss Reduction Action Plan

-

Providing consultation on regulatory and compliance issues

Stuart Lund, the Chief Financial Officer at Miller-Nicholson Inc in Seattle, Washington purchased insurance coverage under Federated's SIR Plan. Click here to read his answers to some Frequently Asked Questions.

Your local Federated representative has access to a variety of tools that help analyze your business risks and help you make informed risk management decisions. Among these are electronic calculators that may be applicable to the unique needs of your business. Click here to Locate Your Federated Representative, or contact AIADA's National Account Executive, Nate Oland, at 800-533-0472, nsoland@fedins.com.

*SIR not available in Virginia.

This article is for illustration purposes only and is not an offer of insurance. Coverage will be determined solely by the provisions of the policy, if approved for issue. The contents of this publication are intended to provide general recommendations regarding risk prevention. It is not intended to be legal advice or to include all steps or processes necessary to adequately protect you, your business or your customers. Please consult your personal attorney and insurance professional for advice unique to you and your business. © 2009 Federated Mutual Insurance Company. All rights reserved.